Most people have read the headlines and seen the news of our local real estate market. It all seems like doom and gloom, but what they don’t tell us is that at any given time there are other markets that are exploding with growth and creating opportunities for those who know what to look for. Those markets are called emerging markets.

There are many factors that make up an emerging market but 2 of the main factors are job growth and population increase. Typically when jobs come into a market what comes with them? More people! And with more people come more jobs and more income to a given area. That growth needs nurturing such as shopping, entertainment and most of all housing. People ultimately need places to live and as investors, our business is to own, manage and control as many properties in those areas where people want to live and work as possible. Sometimes those areas may not be where we currently reside at the moment. But as investors, we live where we want and invest where it makes sense! Right?

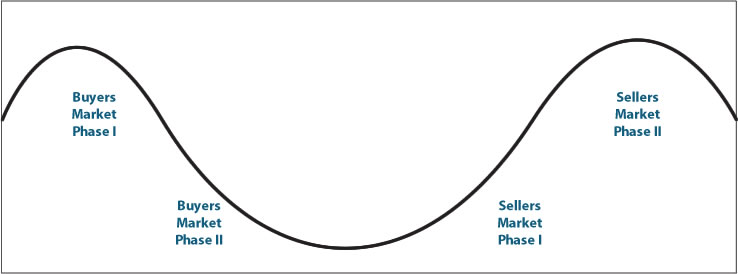

There are 4 main cycles of a market, but we will focus on one for this report. That is the Buyers Market Phase II. In this phase, jobs are coming in and the population is beginning to grow. Properties have been on the market for a while but the bottom of the market has finally come and gone. The sellers are not offering freebies (free months rent, or one dollar move-in specials, etc) as much and are typically ready to sell after suffering through the downturn. The local economy is starting to move with the jobs and people there now. The city begins plans to widen roads and highways to make way for what is to come! During this phase, our investment strategy is to buy and hold for growth. This part of the cycle tends to trend about 5-8 yrs depending on the local governments plan to continue marketing to bring more growth to that city. So get ready…as one of our mentors say about this cycle, “this is the Millionaire Maker”.

Research and timing of this phase are traceable and at the end of it, it is easy to transition to another market that is at the beginning of the same market conditions like the one we are leaving with a big pile of cash. In addition, we are looking to buy property at great prices… which they typically already are at wholesale prices! We know the values will be increased as based rent rises driven by local markers of supply, job growth, and population increase. We are looking to buy at the base of the phase and ride the cash flow wave to our exit point. Imagine buying a property in LA or New York 6 yrs ago!

In these markets, we focus on apartment buildings and multi-family properties for 2 main reasons… cash flow and forced appreciation!

Here’s why… When you move out of your parents home for the first time, most moved to an apartment. If people are relocating to a new area, most look at apartments first to get established, also from the investor’s side let’s look at it this way… You are in an emerging market and you find 155 unit complexes that have average rents that are running about $600 -$700 per month. Then through your research, you find that the rents around there are now $625-$750! That’s great news! As it is called an opportunity for forced appreciation!!! An increase in income in apartment buildings means an increase in value! To the tune of hundreds of thousands of dollars! With new growth in the area coming, investors can continue to create value in those properties and get great growth using the upswing of the emerging market they are in!

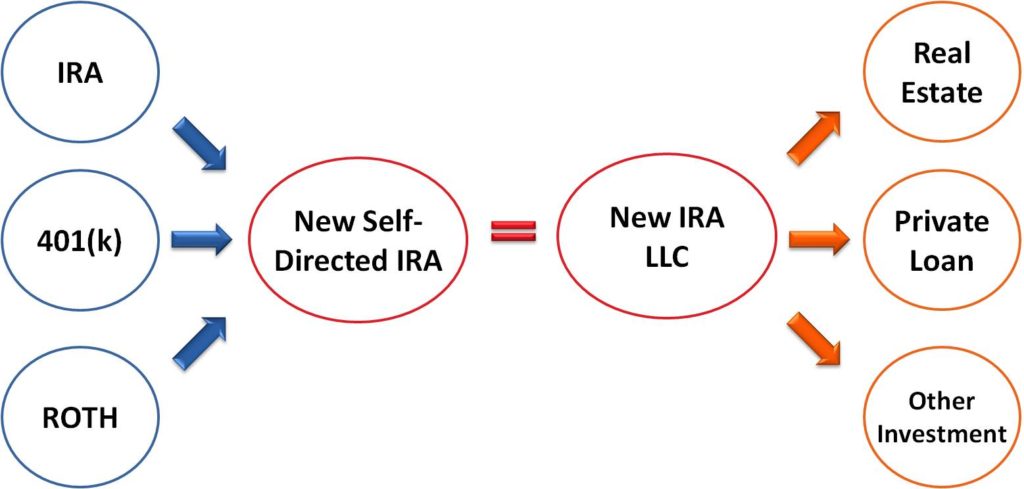

It’s really that simple. The key here is the cycle of the market at that time. Also, apartment complexes provide a great scale of economy. Would you rather have 300 houses or a 300 unit complex with professional property management and staff? 300 roofs or only a few? In a 300 unit complex if you lose 20% of your tenants you are still making money. If you lose one tenant in your house you’re bleeding. In the investor’s complex there are 300 people coming together to pay all your bills, covering professional management and staff, and put money into the bank account monthly! What a great investment!!! You can even invest in these complexes in group ownership and grow your portfolio very quickly with less money and less risk to your current investments. Also never deal with the management issues, research, nothing… just get a great return on your money secured by the real estate, and in some instances, you can invest and get your returns back tax-free by investing using your IRA, 401K or403B.

Contact us to get details on how to invest using a self-directed IRA. We are always looking for additional investors to invest in these deals with us.

Contact us to get details on how to invest using a self-directed IRA. We are always looking for additional investors to invest in these deals with us.

We have only scratched the surface here if you’d like more information on how to invest safely in this emerging markets and make huge returns feel free to contact us at 484-424-7415 additional questions or for more information.

Shannon E Johnson

Phone: (484) 424-7415

E-mail: HBKLLC@gmail.com

Shannon E Johnson is Principal of HBK, LLC. She has been involved in Real estate investing for over 20 yrs and has also been trained by the Principal of The Lindahl Group. She has also been involved in numerous Alumni activities within this group. By doing this she stays updated on the commercial and financial markets as well as effective management strategies as they are always changing.

Shannon’s personal advisors in the commercial field have some of the highest and most respected designations within the Commercial Real Estate industry such as the CCIM designation; known as the Ph.D. of Commercial real estate, CPM, and ARM’s. All of these individuals are a part of numerous organizations that grow the contact network for the HBK, LLC investment group far beyond what one investor can achieve alone. She has also started successful groups and mastermind sessions concerning commercial and business acquisitions and raising capital. She serves as the Company’s asset manager and handles investor relations with a firm belief that, ”by bringing the best investments to our investors we can raise capital by raising awareness.”

HBK, LLC. is an investment company whose mission is to provide quality housing at an affordable price to middle-income earners in Emerging markets nationwide while repositioning apartment complexes for growth to its investors.